Ethereum-is this the new Bitcoin?

Contents

In 2015 ethereum was introduced. Ethereum is an open-source, based on blockchain, a decentralized software interface employed for its cryptocurrency named ether. It allows smart contracts and Distributed Apps to get developed and operate with no downtime, deception, authority, or intervention from a 3rd party.

Whereas bitcoin is a very generally used and prevalent use condition of block chain, Ethereum- is this the new Bitcoin? It can be the killer application that permits this interruption to occur finally.

Is Ethereum the new Bitcoin?

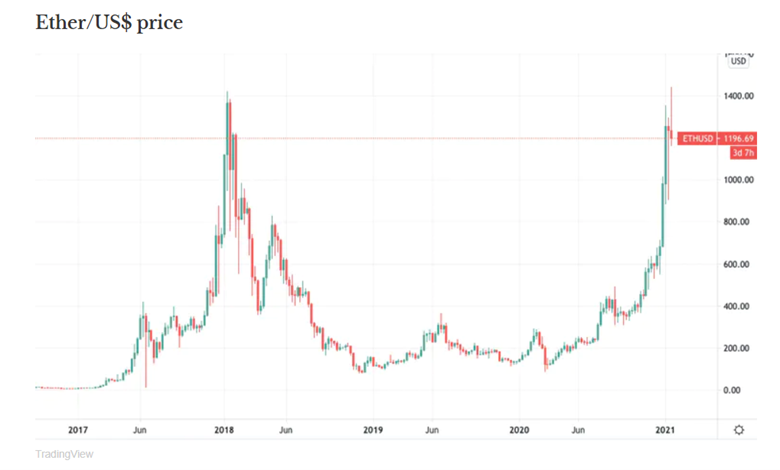

The value of the world’s 2nd most prominent cryptocurrency, ether, reached a new all-time growth of US$1,440 (£1,050) on 19th Jan 2021. Ethereum broke an earlier high position three years before and provided either an absolute value or market capitalization of USD 160 bn even though it has since dropped profit to approx. USD 140 bn.

Ether, which operates on a technological method called the Ethereum blockchain, has value more than ten times its cost when it dropped through the COVID-19 market crash of March 2020. Also, this cryptocurrency is only five years old, so, Ethereum- is this the new Bitcoin? In part, this extraordinary growth in the worth is because of excess cash getting into all the key cryptocurrencies, which are now somewhat secure holdings and the best thoughtful investment.

But price growth of ether has even surpassed the number 1 cryptocurrency, bitcoin, which notably had seven times growth since March 2020. This cryptocurrency has exceeded somewhat because of many changes and the latest attributes getting rolled out. Thus, what is Ethereum, and why is this cryptocurrency valued over large business houses like AstraZeneca and Starbucks?

Fundamental Things to Know About Ethereum

The apps that run on Ethereum operate on a platform-specific cryptographic symbol, ether. Throughout 2014, Ethereum had started a pre-sale for ether that had gained a fantastic response. Ether is the same as a medium for moving all over on the Ethereum interface and is often solicited by developers searching to create and run apps within Ethereum. Ether is generally employed to resolve two purposes: Used as an online currency exchange such as different cryptocurrencies. Also, it is then utilized in Ethereum to run apps and even to devise work.

In 2016, Ethereum got separated into two different blockchains, Ethereum, and Ethereum Classic. It was after a wicked participant seized over $50 mn worth of reserves that had been getting elevated on the DAO, an assortment of intelligent agreements arising from Ethereum’s software interface. The latest Ethereum was a rigid fork from the genuine software to safeguard next to further malware outbreaks. As of Sep. 2019, Ethereum was the 2nd most significant implicit currency in the market, after only Bitcoin. It is swift to get currency ether than bitcoin (approx. 14 or 15 seconds to bitcoin’s expected-uniform ten minutes). Also, there are many more ether components in use than bitcoin.

What is EVM or Ethereum Virtual Machine?

The EVM or Ethereum Virtual Machine can run active contracts that may show financial contracts like options contracts, swaps, or coupon-disbursing bonds. It may also be generally employed to run stakes, meet employment agreements, perform as a conferred escrow for buying high-value goods, and keep up a consistent decentralized betting facility. These are only a few instances of what is desirable with intelligent agreements, and the possibility to change all kinds of legitimate, monetary, and social contracts is impressive.

Currently, the EVM is in its opening, and operating smart agreements is both valuable in sense of ether used and restricted in its processing capability. As per its developers, the conformity is at present as substantial as a delayed 1990s-era mobile device. Yet, it is possible to alter as the rules get extended further. To keep this into view, the system on the Apollo 11 lander had more limited power in comparison to iPhone; it is probable that in a few years, the EVM would be capable of handling complex, intelligent agreements in real-time.

In the ecosystem of Ethereum, ether survives as the inner cryptocurrency that is used to fix the results of intelligent agreements accomplished within the rules. Ether may be then excavated for and exchanged on cryptocurrency exchanges with bitcoin or fiat currencies like USD and is also employed to pay for computational attempts used by nodes on its blockchain technology.

Ethereum and bitcoin- What Things They Have in Common?

Blockchains are digital books that keep vital tamper-proof documents of data. These details get checked by a system of computer links like servers, which no one midway verifies. Ether is only one of more than 8,000 cryptocurrencies that use this technology, which Satoshi Nakamoto only created.

The Ethereum blockchain was first described in 2013 by Vitalik Buterin, a nineteen-year-old genius who was then yielded in Russia but often brought up in Canada. After crowdfunding and growth in 2014, the interface got introduced in July 2015.

Since the bitcoin blockchain technology, every Ethereum transaction gets verified when the links on the network approach an agreement that it occurred – these verifiers are getting repaid in ether for their trade, in a mining procedure.

But the bitcoin blockchain technology is being restricted to allow digital, decentralized cash – signifying cash that is not getting originated from any central organization such as dollars. Ethereum’s blockchain is diverse in that it may host both different online tokens or coins and decentralized apps.

Yet, as each experienced cryptocurrency user understands, both currencies are very resilient and as likely to drop by limits as growing by them. Bitcoin’s cost decreased by 85% in the year later, the final bull market in 2017. At the same time, ether was dropping by 95% at one phase from its earlier high of USD 1,428.

But as bitcoin cryptocurrency has bestowed, first-mover benefit matters a lot in cryptocurrency. Despite bitcoin’s comparative need for attributes, it is not likely to get shifted from its influential position for some time. The same thing is most likely true for the prospect with Ethereum. Thus, Ethereum- is this the new Bitcoin?

What Ethereum and (DAOs) Decentralized Autonomous Organizations Depict?

Innovative agreements can be the construction blocks for whole DAOs or decentralized autonomous organizations that work like businesses, involving financial transactions—purchasing, appointing labor, bargaining deals, adjusting budgets, and increasing profits—with no human or institutional interference. If one believes that businesses are only a complicated web of agreements and commitments of differing size and expanse, then these DAO’s can get ciphered into Ethereum.

DAO unlocks the door for all kinds of latest and exciting opportunities like free tools that hold themselves and individuals getting employed straight by parts of the software.

Understanding Decentralized Apps and Ethereum

Since DAO’s is a view getting actualized in the future, decentralized apps or Dapps are presently getting produced for Ethereum. These standalone apps use innovative agreements and operate on the Ethereum Virtual Machine. Some instances involve micro-payments interfaces, status activities, digital gambling apps, schedulers, and peer-to-peer marketplaces.

The key attribute to Dapps is that they operate crossways, a decentralized system, and get implemented with no need for a primary jurisdiction. Any multi-party app that today depends on a primary server can be generally intimidated through the Ethereum blockchain. This process may finally involve chat, gaming, buying, and funding.

Different Potential Uses of Ethereum and Ether

Block chain-dependent cryptocurrencies have been increasing in popularity since they show a usable option to more conventional payment processes. These cryptos may offer many possible benefits and view as a beneficial method of sending or getting payments.

Different cryptocurrencies can be generally sent or received everywhere globally and can provide a low-cost option to bank wires or regular ACH payments. Amount sent through ether may get cleared very fast. This rate of the realized cost may be very significant as checks, or digital transfers can generally take 14 to 30 days to receive. Amount sent abroad also removes the necessity for currency changes as ether is the same even if it is in Canada or Japan.

Some potential uses of ether involve merchant payment, sending an amount to a buddy for dinner, and even purchasing a cup of coffee.

Final Words- is Ethereum the New Bitcoin?

What Bitcoin did for cash and amounts by using blockchain technology, Ethereum can do for apps of all forms and dimensions. So, could we say Ethereum- is this the new Bitcoin? With an inherent scripting style and shared virtual machine, intelligent agreements create all kinds of tasks with no need for a committed 3rd party or necessary authority. Ether connections can then be adjusted for their processing capability in operating these decentralized apps, and finally, complete decentralized self-governing companies may survive in an ether marketplace.

References: https://theconversation.com/ethereum-what-is-it-and-why-has-the-price-gone-parabolic-153733

Article Disclaimer