Why is money management so important in Forex in 2021?

Contents

Even if you trade in Forex, binary options, or manage an investment portfolio in the main markets, a robust money management plan is all required. A trader should generally make choices respectively to all kinds of trading. One of the very significant ones is the sum of funds allocated to every trade. Money management is so crucial in Forex that you can manage trading and funds in the best feasible way through it. As Risk management is also very important for Forex.

Reasons why money management is so crucial in Forex.

Because of volatility, trading in the forex market is hazardous. Money management must be regarded as nonnegotiable breakthrough strategy for both learner traders and forex experts to secure your investments. Since, without appropriate money management, you cannot be a successful trader.

Let’s understand it with this example:

Suppose one trader has an excellent forex trading plan and is successful 95% of the all-time, but he does not handle their risk anyway. And, another trader possesses a trading plan with an average 60% success rate, yet he/she goes after the proper money management practices. So, who would end the month with huge profits? The response is the second trader because the first trader is far more likely to miss his entire profit on a one-falling trade.

Several traders become wrong in avoiding checking that you should not only aim to generate profit from a sole trade but also base your plan on attaining gains in the long term. That’s where the capability of managing your investments and trade assets becomes essential. And that’s why money management is so important in Forex.

How to manage risk and money in Forex?

Managing risk in Forex is a prevalent idea. In reality, risk management in Forex includes recognizing, estimating, and setting up currency trading prospects and then involving in the usage of resources to reduce, handle and check the possibilities of unfavorable events, like trading declines, and increase the chances of affirmative events, like trading profits. Money management must be the main component of a forex trader’s complete risk management plan. It leads to an assortment of practices that assist you to increase your profits, reduce your losses and enhance your trading account.

Managing money for traders generally focuses on problems like finding the risk tolerance level previous to getting into the order, moderate stop-loss area, reducing stop-loss, generating profit, partly or entirely leaving commands, and adding extra charges in the market. Each trader would have a diverse method of controlling capital, created from data and individual trading knowledge.

The significance of money management in the forex trading

Money management is crucial in Forex because the risk directs to the probability of dropping part or all of a shareholder’s capital when bringing the investment. Risk management would assist investors in checking threats previous to doing transactions, knowing how the drops in each condition would be, how to lowest and highest the scope of the investment, the period of investment, the instance to finish the buy, and then to different associated factors.

For specific forex shareholders or traders, money management is generally more used in comparison to risk management. But, risk management is a vast concept. It discusses capital problems and other problems as well that traders confront different risks like computer systems employed for events, internet broadcast. All components create the danger that all traders have to go through.

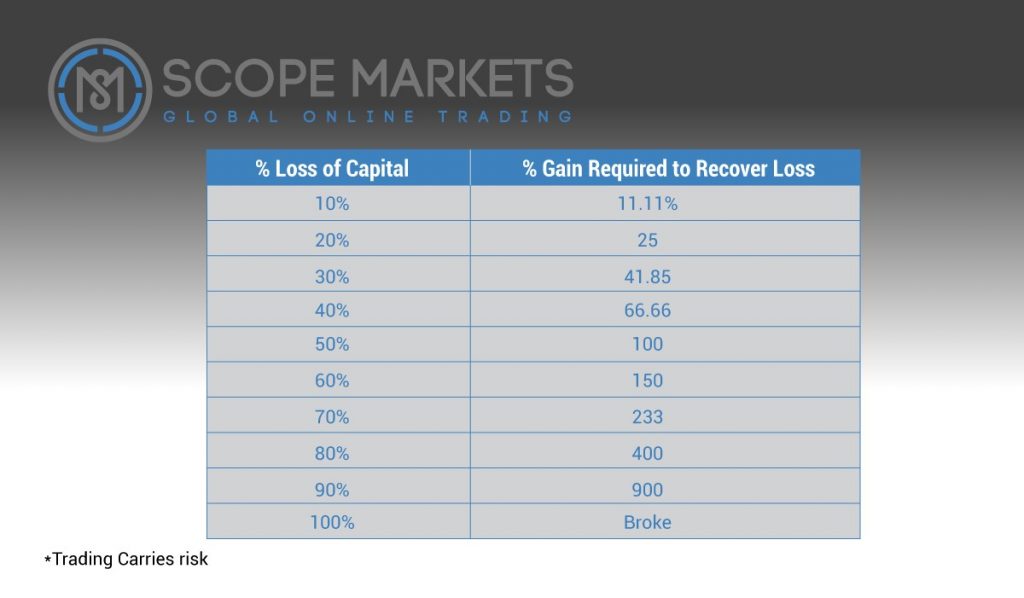

The table below shows the significance of money management.

This table shows that once the forex trading account reduces, it is tough to overcome the losses. If a trader has dropped 50% of his first capital, he needs to profit 100% for the outstanding money to come back to breakeven. Particularly, if a trader misses up to 90% of the first capital, he needs to make a profit of 900% for the outstanding money. The latest account would be as earlier. This capability is very questionable.

By the above instance, we would understand the significance of money management. It will assist us in having the capital to resume trading forex after losing continuously.

Some money management and trading strategies to follow

Traders can usually match the each-trade sum with particular option trading tactics. One instance will be a compounding approach, where investment sum grows or falls together with improvement. One more instance will be variation in investment sum together with the success ratio of tactics. Still, another will be the usage of trade solutions like Binary Options Robot Software. These solutions must be well-assessed before making verdicts related to trade amounts.

Strategy for Deposit and Withdrawal.

Capital management goes ahead only by choosing the investment sum. It also continues to the region of deposit and withdrawal. Even beginner traders understand that it takes cash to generate cash. Thus, signifying that you would need a subsidized account to trade actively.

Whereas it is always expedient to deposit again, not possessing a supported account has created several traders to miss best the chances to profit. There can also be banking charges. It is not stating that you must not take out profits. After all, the aim of trading binaries or Forex is to produce profits. But, there must be a strategy in position to make sure the account is ever ready for live trading.

Analyze and Adjust.

Even though following a money management strategy in place needs the trader to stay disciplined and fixed to it, an evaluation of its efficiency is also required. Once you have been going after a specific strategy for a definite time, you must consider stock. It would help if a trader thought that they could accomplish the profit target. A trader must do it in connection with a complete review of your trading tactic as usual.

If you have a plan on trading, then keep a money management strategy in place. This would work as safety of your funds and assist you in earning more cash in the long term. There is no fixed plan for everybody, as each trader has diverse targets and anticipations for profit improvement. Usually, deliberate and steady is the most suitable way for traders who are getting initiated. After some time, the plan can get customized to let more significant trade volumes and withdrawals since profits increase.

Ignore aggressive trading.

Aggressive trading is the fall of various novel traders – so we recommend thinking even if or not a small series of losses will be suitable to remove most of your risk assets. If yes, then this suggests that every trade has a considerable risk linked to it. Possessing a stern and documented plan that includes money management features would assist you in managing risk, thus, helping you ignore aggressive or proactive trading.

Ignore trading a similar currency similarly.

If you have an open Euro/US Dollar trade, you do not wish to create a USD/JPY pair trade differently. That’s where several people who are going after their analytics but not considering their money management would flounder. It is simple to view the basic details, but the reality is that the USD/JPY and EUR/USD trades would be doing far from it because of both the pros and cons of the dollar.

When the dollar changes dramatically, both trades will change. That may look like the best idea, but it is a fall of control as you instantly have huge money linked to a single business. See, this does not add if you deliberately trade only 1/2 of your tradable stocks in each; this is a kind of hedging.

Make use of stop-losses.

A stop-loss position would assure that you will not miss a large sum of cash on a sole trade. Also, it will protect your funds from sudden changes in the market. As the occurrence of a loss ever endures, fix your stop-loss position; thus, it goes beyond not over 2% of your trading surplus for any provided trade.

Know about leverage.

Even though leverage gives the chance to increase profits generated from your possible risk assets, traders have to know that increased leverage also improves the potential loss for each trade. As an outcome, we recommend only employing leverage when you have a good understanding of the possible losses.

Consider long-term trading.

Victory or defeat of a trade would be generally identified by how it works in the long term. So, make sure you stay cautious of risking your future success by keeping massive significance on the victory or defeat of a present trade. Also, make sure you follow a forex calendar, staying updated with current events and other changes in the news to notify your plan and money management for later trades.

The Bottom Line- Money management is so crucial in Forex.

So, by the above points, we can say that money management is so important in Forex. Also, it should be as adaptable and as diverse as the market. The only common rule is that all tradesmen in this market must follow some kind of it to succeed.

References: https://medium.com/@forextory.vietnam/why-is-forex-money-management-so-important-2bfd0e9b76de

Article Disclaimer