How is GDP data influencing currency markets?

Contents

Gross Domestic Product (GDP) shows the full fiscal value of goods and services built at a specific time in a country. In other words, GDP gives a complete overview of a nation’s market. It is generally employed to assess the growth level and the economy’s strength on the whole.

The GDP data is one of the various macroeconomic pointers which are usually released to check a country’s market. In the forex markets, there are several GDP statements issued. These statements cover the GDP at diverse periods.

GDP data assessment to take currency trading decisions

GDP (Gross Domestic Product), Interest Rates and Inflation

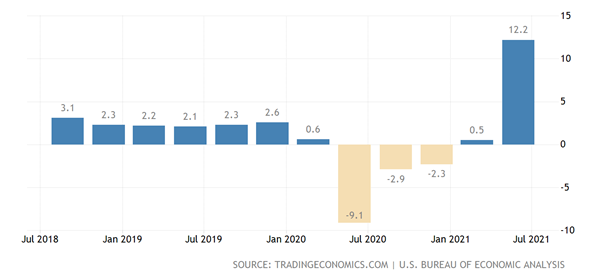

The first issuance of the GDP in the United States is 4 weeks following the quarter finishes. Whereas the last release occurs 3 months after the quarter finishes. Both are then issued by the Bureau of Economic Analysis(BEA) at 08:30 HRS Eastern Time. Generally, investors look for US GDP to increase between 2.5%-3.5% for each year.

With no view of inflation in a somewhat increasing market, interest rates can be then kept at 3%. However, reading more than 6% will show that the US economy is generally risking overheating and, that can, in turn, increase fear of inflation.

Federal Reserve and interest rates

So, the Federal Reserve will have to increase interest rates to control inflation. As well as keep the checks on an overheating market. Keeping up price resistance is one of the tasks of the Federal Reserve, therefore, the GDP needs to stay in the goldilocks zone: not too hot and not too cold.

GDP must not be high enough to activate inflation or very low where it can lead to recession. A recession is generally described by two consecutive quarters of negative growth. GDP value differs from one country to another. For instance, China has reported two – figures for GDP values.

Forex traders and GDP data

Forex traders are very much involved in GDP since it is a full health report sheet for a nation’s economy. A country is then paid for an increased GDP with an increasing worth of its currency, as powerful economies tend to be more active by making raised inflation. This, in turn, points to central bank hiking rates to reduce growth. As well as include the increasing unexpected sight of inflation.

But, a nation with reduced GDP has a much-reduced interest rate hike anticipation. Indeed, a country’s central bank that involves 2 consecutive quarters of adverse GDP can even select to spur their market by reducing interest rates.

Currency pair trading through GDP data

Quarter by quarter numbers tend to create many variable differences in the complete trend. For example, positive GDP figures surpassing views Quarter by Quarter can be short-lived when thinking of year-on-year details. Year-on-year data gives a wider prospect which can likely show a whole trend.

Most essential GDP data for the currency markets

- Australia, the US, and New Zealand’s quarterly GDP data affect their currencies.

- Canada issues GDP data monthly together with a standard and quarterly basis.

- Eurozone issues GDP data quarterly. Also, covers GDP report estimates that are like the first GDP issuance.

Reasons that GDP is a significant economic indicator

If a nation has an increasing GDP number, then it is usually affirmed that the country has a strong economy and a good living standard. As it is generally valued the same in each country, it is one of the simplest methods to check financial health and growth between many countries.

Understanding GDP using examples

Instances that explain why GDP is such a common method of holding economic strength and action.

a. Let us begin with a car produced in a country. Let us suppose that it is a Ford Fiesta. When the Ford Fiesta is generally manufactured, GDP does not only hold its final price label. GDP also considers the source of the elements employed to produce the car also to their worth.

b. So that the outer and inner supplies and methods employed to make the Ford Fiesta charge further. This would signify whether the car itself has a high value, the GDP will signify adverse growth. That is, it considered many means to make something whose worth was below the charges of these means.

c. This example depicts the fundamentals of why GDP is usually praised as the best gauge of economic activity, as it provides a thought of success and decline of economic activity apart from the last value.

d. GDP is the standard analysis for economic growth in common economics, governments, and public insight.

The impact that GDP data leaves on the forex markets

If you have any global cash dealings, then you know that money exchange rates play a significant role in your selections and their time. Exchange rates are usually affected by a nation’s GDP report. Whereas the connection is not direct, it is somewhat powerful.

The GDP data is then viewed as Tier 1 data, signifying it is a huge impact issue. Markets tend to shift well when the report is generally issued. Also, the market volatility rises based on how powerful the real effect comes in from the projected views.

The effect GDP data has on the Forex market, or an exchange pair relies on many factors. Thus, do not foresee markets behaving, in the same way, each time a GDP record hits or declines below views.

Different factors that impact currency markets

- The initial factor to think about when trading the GDP release is even if the markets have now priced in a good or a more critical number. In many conditions, the sub-elements that stock into the GDP like Manufacturing, Production, and Services PMI point to betoken on what the GDP forecast may be. The way the markets works based on the GDP statement comes down to how well the real number has varied

- Seasons also play a big part in forming the GDP releases. Say, in the United States, the first quarter GDP usually tends to be the smallest. While the 2nd and third-quarter GDP generally higher. Particularly harsh cold periods tend to move down the quarter one GDP data down a lot more.

When a nation’s GDP drops, it signifies the country’s financial growth is reducing or sustaining. But, when a nation’s GDP falls to adverse numbers, that is regretful news. It signifies the economy is contracting and, there is a loss of potency and buying and, as an outcome, a lack of jobs. In different words, it likely signifies the country is undergoing a recession. As an outcome, there is usually a comprehensive plan to keep a nation’s GDP on a real growth route.

- GDP variations are not the only method GDP can impact a currency’s value and its following exchange rates. Investors generally choose to put their cash in nations that show increased GDP growth rates. As investment generally strengthens the currency of that nation, GDP has an implied effect on it via influencing investment verdicts.

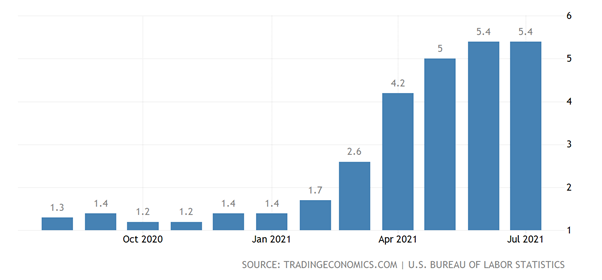

- GDP growth rate may sometimes be a pointer to the inflationary movement in the nation and most central banks make use of interest rates to control inflation. Inflation, in a different way, has a very big effect on a currency’s worth.

Let’s suppose a country’s Nominal GDP is going upwards at an incredible speed. This is not always a good sign as it may signify that something is not going as required with the nation’s growth dynamics. For example:

• More products are being manufactured at similar prices as earlier.

• A similar sum of products is being manufactured but at increasing prices.

• More products are being manufactured and the costs are rising at the same time.

All the above situations come up when the central banks are making diverse decisions. Say, in the second condition when a similar sum of goods was being manufactured but at a growing price. Signifying that when economic activity may be deteriorating, customers will still get cash strapped with growing prices.

Generally, in such conditions, central banks such as Federal Reserve interrupt by varying interest rates. Increasing or decreasing interest rates usually impact the nation’s forex worth, as well as make stockholders either pump more cash into the country or take cash out.

Financial and GDP data tips for forex traders

Consumer Price Index (CPI) is generally issued every month by most of the larger economies. This is done to offer a timely look into present growth and levels of inflation.

Basic traders check economic data statements and, several do so to exchange the news. This is necessary for traders when they are trying to assess and manage risk. Since there is high market volatility after significant releases.

GDP Data Summary

GDP data is one of the high-impact financial indicators that can form not only the market rates but also has power over monetary policy choices.

Traders must not look at GDP numbers in solitude, but think of how the data will affect the wider market setting like monetary policy hopes.

References:

Article Disclaimer