What is Risk Management in Forex in 2021?

Contents

Successful forex risk management in Forex, lets traders reduce deficits or losses that take place as a consequence of exchange rate variations. So, having the best risk management strategy can create secured, more disciplined, and less annoying currency trading. In this article, we are covering the basics of risk management in Forex and tips for successful risk management.

What risk management in Forex signifies?

Risk management in Forex involves specific actions that let traders safeguard next to the flaws of a trade. Higher risk signifies a higher possibility of huge returns – but including a higher prospect of notable losses. Thus, being able to control the risk levels to reduce loss, whereas increasing profits, is the key skill for any Forex trader to possess.

But, how does a forex trader perform this? Risk management in Forex (unlike money management in Forex) can involve creating the proper position volume, fixing stop losses, and keeping emotions under control when getting in and out of positions. Executed well, these measures can be very well the distinction between money-making trading and dropping it all.

Tips for effective risk management in Forex

1. Find out your risk threshold

This is a particular choice for anybody who aims on trading any exchange. Many trading advisors would throw out figures such as 1, 2, or up to 5 percent of the whole worth of your account gambled on each trade that you placed, but your convenience with these figures is much dependent on your expertise. Beginner traders are not much sure of themselves because of their inadequacy of knowledge and awareness with trading or with the latest system. So, it is prudent to use a smaller ratio of risk levels.

Once you turn out more convenient with the system you are going through, you can hold the urge to grow your ratio, but be careful not to go very high. Sometimes trading methods can create a series of losses, but the target of trading is to both recognize a return or keep enough to create another trade.

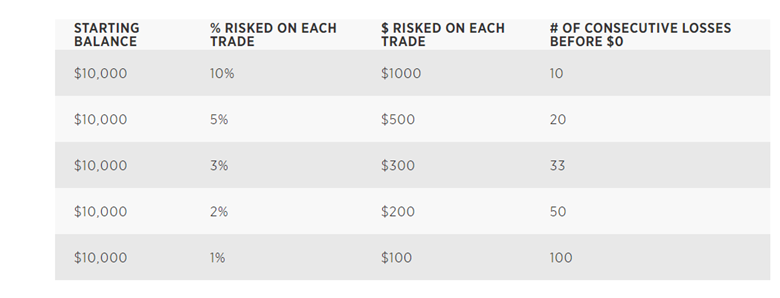

Say, if you possess a trading process that keeps 1 trade each day on an average and you are staking 10 percent of your starting monthly balance on every trade, it will only possibly take ten direct losing trades to fully reduce your account. Thus, whether you are an expert trader, it’s not very much sensible to take so much risk on a single trade.

Thus, if you were to speculate 2 percent on every trade that you put, you will have to drop 50 sequential trades to reduce your account. So, which do you consider is more plausible: dropping 10 direct trades, or dropping 50?

2. Personalize your agreements

The number of methods to use in trading is practically never-ending. A few methods have you employ a very particular stop loss and profit point on every trade you put, whereas others differ much on the topic. Say, if you make use of a plan that asks for a 20-pip stop-loss on every trade and you simply trade the Euro/US dollar, it will be simple to find out how many agreements you may wish to get into getting your needed outcome. But, for those tactics that differ on the dimension of stops or even the tool traded, finding out the sum of agreements to enter may become somewhat difficult.

One of the simplest methods to ensure you are going as near to the sum of cash that you wish to risk on every trade is to personalize your trade position sizes. A regular lot in currency trading is 100,000 parts of currency, which shows $10/pip on the Euro/US dollar if you are using the USD as your first currency; a mini order or lot is 10,000.

If you needed to risk $15 for each pip on a Euro/US dollar trade, it will not be possible to do this with regular lots and could compel you to speculate both excessive or too small on the trade you put, while mini as well as micro-lots can send you to the needed sum. The same can be then stated about wishing to risk $12.50 for each pip on a trade. Both regular and mini lots do not succeed to get the needed outcome, while micro-lots can assist you to attain it.

In the world of trading, possessing the compliance to risk what you need, when you need, can be a decisive factor to your trade success.

3. Find out your timing

There cannot be anything more disappointing in trading than abstaining from a likely successful trade just due to you were not prepared when the possibility increase. with forex implying a 24-hour market, that issue shows itself very often, specifically if you trade shorter timeframe charts. The most reasonable solution to that issue will be to make or buy an automatic trading robot. But that choice is not applicable for a big section of traders who are both doubtful of the technology or do not wish to abandon the controls.

It signifies that you need to be ready to put trades when the possibilities grow and stay full of mind as well. Awaking at 3 am to put a trade generally does not restrain unless you are being used to taking only 2 to 3 hours of rest. Thus, the normal person who has work, children, soccer training, a cultural life, and a garden that requires getting harvested must be somewhat concerned regarding the moment they wish to perform. Possibly 4 to 8 Hours or Regular charts are more responsive to that style where circumstances may be the very important part of trading comfort.

One more method to risk management in Forex is when you are not present your system is to fix stop orders that are trailing. Trailing stop orders can be a necessary component of any trading plan. They let a trade proceed to grow in worth whereas the price of the market shifts in a positive way, but involuntarily finishes the trade if the price of the market abruptly shifts in an adverse direction via a particular distance.

When the price of the market shifts in a positive direction, the trigger cost reflects the market cost by a particular stop distance. If the market cost shifts in an adverse direction, the trigger cost stays fixed and the interval between this cost and the market cost becomes very small. If the market cost continues to shift in an adverse direction till it does not reach the trigger cost, an order is usually activated to finish the trade.

4. Ignore gaps of weekend

Many exchange partners are aware of the truth that many popular markets finish their trades on Friday midday Eastern Time in the United States. Shareholders pull out their stuff for the weekend, and price charts all over the world stop since if prices stay at that point until a later time they are capable of being traded. But, that fixed position is a delusion; it is not actual. Prices are still shifting forward and backward based on events of that specific weekend and can shift much from where they held on Friday until the moment they are noticeable once more later the weekend.

This can make market gaps that may truly go beyond your expected stop loss or target of profit. For the latter, it will be the best thing, for the previous– not so many.

Whereas gaps are not certainly general, they do take place and can pick you off a defender. Since in the example below, the gaps can be very big and could skip right on a stop if it was kept all over in that gap. To ignore them, just leave your trade previous to the weekend blows, and maybe also look to utilize them via employing a gap-trading method.

5. Go through the news events

Different news happenings can be especially unsafe for traders who are searching to control their risk too. Several news happenings such as vocation, central bank settlements, or inflation news can make big changes in the market that may make gaps such as a weekend break, but a lot more very fast.

Final words- Risk management in Forex

Risk management in Forex is subjective, but as prolonged as you can gauge risk you can be able to manage it. Only don’t miss the point that risk can be generally increased by using excessive leverage in reverence to your trading resources in addition to getting increased by a need of the market liquidity. So, assess your trades daily with a trading record that would assist you in knowing what you did correctly, and what you need to change. With a correct approach and the best trading practices, taking some risks is the only method to get great rewards.

Article Disclaimer